proposed federal estate tax changes

Section 7 - Basis for Discharge Discharge of property from the federal tax lien may be granted. On July 13 2020 the Commission held a workshop concerning the proposed changes and conducted panels with information security experts discussing.

Biden Budget Biden Tax Increases Details Analysis

A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base.

. The proposal would require wealthy households to remit taxes on unrealized capital gains from assets such as stocks bonds or privately held companies. Kline-Miller Multiemployer Pension Reform Act of 2014. There is a fee for seeing pages and other features.

A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assetsThis includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a capital levy. The redistribution of income from the Biden administrations tax proposals would involve many winners and losers not only across different types of taxpayers but also geographically across the country. Employer Identification Number EIN Small Businesses.

Must contain at least 4 different symbols. New Tax Foundation modeling finds that the Inflation Reduction Act would result in a net revenue increase of about 324B but would do so in an economically inefficient manner reducing long-run economic output by about 02 percent eliminating about 29000 FTE jobs and reducing average after-tax incomes for taxpayers across every income quintile over the long run. In June 2016 USA Today published an analysis of litigation involving Donald Trump which found that over the previous three decades Trump and his businesses had been involved in 3500 legal cases in US.

Increases the corporate income tax rate from 21 percent to 28 percent. The Biden tax plan also includes the following proposed business tax changes. Papers from more than 30 days ago are available all the way back to 1881.

News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook. In the NPRM we proposed an exclusion from the definition of legal entity customer for charities and nonprofit entities that are described in sections 501c 527 or 4947a1 of the Internal Revenue Code of 1986 which have not been denied tax exempt status and which are required to and have filed the most recently due annual. But with rent increasing and housing prices continuing to rise too many young people donât see a clear path to affording the same lives their parents had.

General Property Vehicles Vessels Aircraft. Form 941 employers quarterly federal tax return. Enter NA for the amount of proceeds the IRS can expect if you anticipate there will be no proceeds.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. As the accompanying table illustrates for an asset worth 100 million all of which is a capital gain for the sake of simplicity the two changes would mean an immediate. ASCII characters only characters found on a standard US keyboard.

Creates a minimum tax on corporations with book profits of 100 million or higher. Bidens proposal would take the. Inactive Inspector Status Complaint Form.

Provide the amount of proceeds the IRS can expect for application to the tax liability. For example references to the applicable distribution period have been changed to refer to the applicable denominator II. Although the convention was intended to revise the league of states and first system of government under the Articles of Confederation the intention from the outset of many of its proponents chief among them James Madison of Virginia and Alexander Hamilton of New.

There are various tax systems that are labeled flat tax even. Contract Changes Presentation TREC Advertisement Rule Review - Whats In A Name Real Estate School Bond Application for Inactive Broker or Sales Agent Status 2022 Purchase Orders and Contracts through August 31 2022 Advertising Town Hall Presentation Agency Strategic Plan 2023-2027 Application for. Of the 3500 suits Trump or one of his companies were plaintiffs in 1900.

Even if rental real estate rises to the level of a section 162 trade or business it is generally reported on Schedule E Part I because rental real estate is generally excluded from self-employment taxable income under section 1402a1. 6 to 30 characters long. Provide the proposed property sale amount 2.

It is not necessarily a fully proportional taxImplementations are often progressive due to exemptions or regressive in case of a maximum taxable amount. The Federal Trade Commission FTC or Commission is issuing a final rule Final Rule to amend the Standards for Safeguarding Customer Information Safeguards Rule or Rule. Beginning in 1950 site selection for public housing.

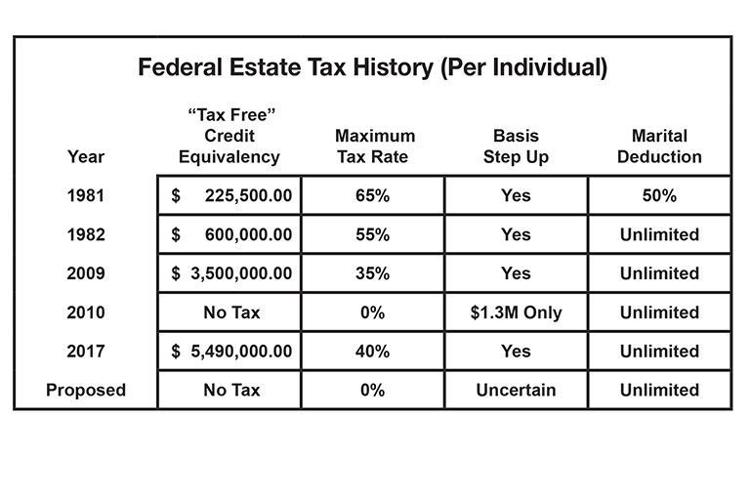

This came in handy in 1949 when a new federal housing act sent millions of tax dollars into Chicago and other cities around the country. These proposed regulations include minor changes to existing provisions of 1401a9-9 to conform the terminology in that section to the new terminology used in proposed 1401a9-5. Expands the estate and gift tax by restoring the rate and exemption to 2009 levels.

The Constitutional Convention took place in Philadelphia from May 25 to September 17 1787. The agencies are requesting comment on proposed changes to clarify instructions for reporting of deferred tax assets DTAs consistent with a proposed rule on tax allocation agreements and a new item related to the final rule on the. Federal and state courts an unprecedented number for a US.

Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031. Rental real estate is usually reported on Schedule E Part I and is not subject to self-employment tax. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

Canadians see owning a home as key to building their future and joining the middle class. News Sports Betting Business Opinion Politics Entertainment Life Food Health Real Estate Obituaries Jobs. Keep reading by creating a free account or signing in.

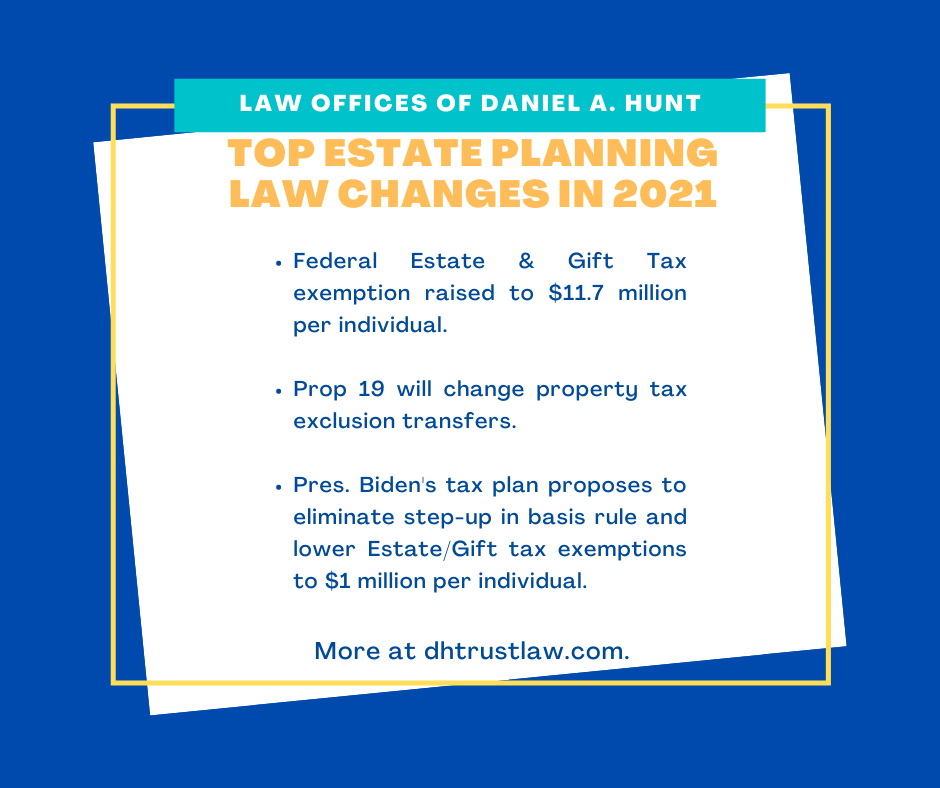

In addition to Bidens proposed tax hikes large estates would also be subject to the current estate tax of 40 percent above an exemption of 117 million per person. This week President Biden introduced a new tax proposal as part of the White House fiscal year 2023 budget to raise taxes on households with net wealth over 100 million.

Death Taxes And Change Are Certainties

Proposed Taxable Estate Deduction Changes Dallas Business Income Tax Services

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Estate And Inheritance Taxes Around The World Tax Foundation

Election Special Bulletin 1 Tax Plan Proposal

Estate Tax Current Law 2026 Biden Tax Proposal

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9758347/tpc_chart1.png)

7 Stats That Explain What The Senate Republican Tax Bill Would Do Vox

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/RWUIN5KCSMYSBRP3CBQGEBG3Y4.jpg)

Spilka Signals Willingness To Deal On Estate Tax The Boston Globe

Ryan Tax Plan Reserves Most Tax Cuts For Top 1 Percent Costs 4 Trillion Over 10 Years Itep

Planning For Possible Estate And Gift Tax Changes Windes

How Could We Reform The Estate Tax Tax Policy Center

Wills Estate Planning Probate Seminar North Brunswick Public Library

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Estate Tax Definition Federal Estate Tax Taxedu

Repealing The Estate Tax Would Not Create A Permanent Aristocracy Overnight Tax Foundation